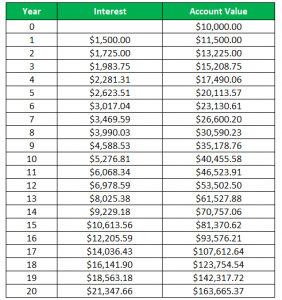

Why Compound Interest is ImportantĪll of the examples in today’s post and the spreadsheet are overly simplified to demonstrate how compound interest works.įor the first example above, think of it as an interest-bearing savings account (if you can dream of one paying 5%). Spending the earnings will prevent the compounding from occurring. But it only compounds if you reinvest the earnings (or hold for capital appreciation). The calculation is the same whether you start with $0.01 or $1 billion. If an investor puts $1,000 into an investment that earns 5% annually, that investment will pay $50 in year 1.Īt the start of year 2, the investor has $1,050.00. Here’s a simple example that we’ll build on for the rest of the article. Interest computed on the sum of an original principal and accrued interest.

Think of compound is as earning interest upon interest, or as Merriam-Webster puts it: Conclusion – Compound Interest Examples.Where the Magic Happens - Exponential Growth.

0 kommentar(er)

0 kommentar(er)